There is an evident increasing demand for warehouse space in the Western world and it is estimated to continue to grow. New trends, that will influence the logistics landscape of the future and stimulate further growth of the warehouse and distribution center sector, are anticipatory logistics, customer-centric production and the expectations for same-day delivery.

Strong demand for warehouse and distribution center space

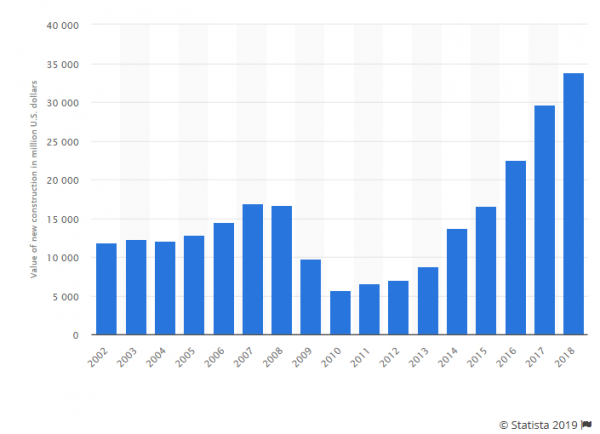

As a result of the booming e-commerce, the growing demand for and the increased new construction of warehouses and distribution centers are both evident and significant. It is difficult to access worldwide data, but the US statistics presented by Statista may represent the trend at least in the Western world.

Value (million USD) of new private sector warehouse construction in the US in 2002-20181

There was a decline in new construction 2009-2012 due to the recession, but after that a powerful upsurge in demand has taken the private sector of new warehouse space to completely new levels.

The 2018 edition of a survey, conducted annually by Peerless Research Group on behalf of Logistics Management among professionals in logistics and warehouse operations in the US2, shows a strong trend toward bigger and taller facilities and that the average square footage for distribution centers amounted to 672,080 square feet (62,438 m2), which was well over the 473,400 square feet (43,980 m2) in the prior year’s survey. In addition, 76 % of the survey participants had expansion plans!

Same-day delivery; the new standard?

The comprehensive Swisslog report “Future perspectives: planning for the warehouse of the future”3 presents interesting research data and some coming trends in logistics:

- Anticipatory logistics: online retailers predict coming orders based on previous sales statistics and customer behavior data for a geographic area and store goods closer to the potential customer to enable fast delivery. It probably results in more smaller distribution centers closer to the city centers.

- Customer-centric production: Consumers increasingly demand their own customized products and small batches, even down to batch size one, may become a reality. In the trace of the 3D print technology, production of retail products is likely to become individualized and local in the future.

- The custom-centric production trend indicates less need for warehouse space, when products are shipped directly from production to the customer, but at the same time, logistics required to support the customized production will increase.

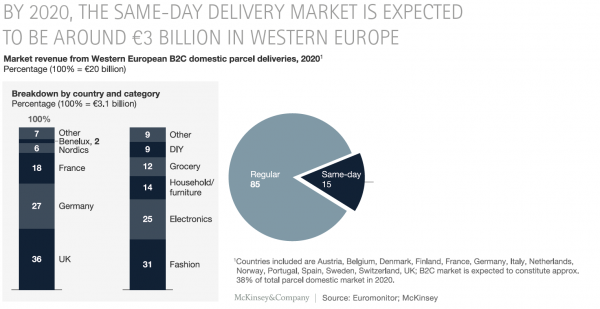

- Same-day delivery: According to DHL’s 2017 Trend Research3, 41 % of the US consumers have used same-day or on-demand delivery services and this development will only continue to grow. Referring to statistics in a McKinsey report3, by 2020 the same-day delivery market is expected to be around 3 billion EUR in Western Europe!

The logistics landscape of the future

After a closer look at the current trends and the predicted further development, an image of the future urban logistics landscape emerges! Huge warehouses and distribution centers are built outside the cities in areas, where land is accessible and more affordable, but still close to strategic transportation routes. In closer proximity to the cities we will find smaller warehouses and distribution centers for “anticipatory logistics” purposes for same-day deliveries directly to e-commerce customers or for fast delivery to physical stores in the city or local customized production facilities.

The conclusion is that the future for the warehouse and distribution center sector looks bright and that the demand for both small- and large-scale warehouse space is expected to grow in the future logistics landscape. Download the entire article as pdf

A vision of the smart logistics center

To conclude this article with an inspirational view of tomorrow, let us look as one example look at JD.com’s vision for the smart and fully automated logistics center of the future! JD.com is the largest online retailer in China. With over 320 million customers, it has a vast network of warehouses and distribution hubs and delivers most orders in less than a day. https://youtu.be/u2ucFo-cghQ

Download the entire article as pdf

1 Source: https://www.statista.com/statistics/184484/new-private-sector-warehouse-construction-in-the-us-from-2002/

2 Source: https://www.logisticsmgmt.com/article/2018_warehouse_distribution_center_survey_labor_crunch_driving_automation

3 Source: http://info.swisslog.com/rs/350-HXH-519/images/024496_WarehouseOfTheFuture_WhitePaper